Why did borg retire so young? Originally Answered: Why did Borg retire so early? It is mainly because of the John McEnroe’s win over him in Wimbledon 1981 Finals. Bjorn Borg told that he was not too upset after this match and he even told he lost interest in Tennis during the tournament. Borg went on to lose to McEnroe at the 1981 US Open.

Why did Bjorn Borg leave so young? Before his 1981 U.S. Open upset, Borg had won 11 Grand Slam titles and had compiled a record of the most consecutive wins in tennis history. … Something had changed internally for Borg, and by late 1982 he announced to his family, coach, and friends that tennis was no longer fun. The 26-year-old star wanted to retire.

Why did Bjorn Borg retire at age 26? The best explanation Borg can give for his sudden retirement is that he just lost motivation. He had been on the professional circuit from the age of 14 and dedicated himself to playing tennis as well as he humanly could. Without that drive there was no point continuing.

What age did Borg retire? On January 23, 1983 while traveling in Bangkok, he announced his retirement at age 26. Borg flirted with comebacks in 1991, 1992, and 1993, but all to no avail. When Borg retired from tennis in 1983 after a decade on the tour, he held the Open Era record for most major championships with 11.

Why did borg retire so young? – Related Questions

How much money has the average american saved for retirement?

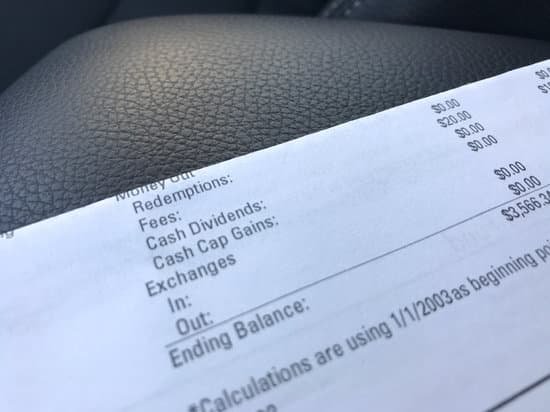

On the whole, the survey found that Americans’ average personal savings have grown 10% year over year, from $65,900 in 2020 to $73,100 in 2021. Retirement savings have jumped 13% from $87,500 to $98,800.

How much is full military retirement?

“That equates to around $30,000 to $35,000 per year for a typical enlisted person and around $60,000 to $70,000 for the typical officer.” These estimates refer to those who have served full time active duty for their entire career.

Is mass teachers retirement system a tax deferred plan?

The superannuation retirement allowance that you receive from the MTRS is exempt from taxation under the Massachusetts income tax laws. The federal government (Internal Revenue Service (IRS)), however, will tax a large portion of your retirement allowance immediately upon retirement.

How much should i have to retire at age 60?

According to guidelines created by investment firm Fidelity, at age 60 you should have saved roughly eight times your annual salary if you plan to retire at age 67, the age at which people born after 1960 can collect full Social Security benefits.

Do general motors retirees have life insurance?

Retirees are encouraged to sign up for Automatic Bank Withdrawal (ABW) for their life insurance premiums to ensure no lapse in coverage. … If you need more information regarding paying your life insurance premiums, please contact MetLife at 1-800-489-4646 and select the prompt for Life Insurance.

Are retired military exempt from mn state taxes?

Minnesota allows subtraction from federal taxable income of most other types of military pay that are taxed at the federal level. Beginning in tax year 2016, Minnesota also allows an income tax subtraction for military retirement pay, including survivor benefit plan payments.

How much does a household need for retirement?

Most experts say your retirement income should be about 80% of your final pre-retirement annual income. 1 That means if you make $100,000 annually at retirement, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce.

Is mats sundin number retired?

On 15 October 2016, Sundin’s number 13 jersey was officially retired by the Toronto Maple Leafs in a ceremony prior to their centenary season home opening game against Boston. A few months later, Sundin was named one of the 100 greatest players in league history by the NHL itself.

When did yogi berra retire?

But when Yogi finally retired from playing in 1963, it wasn’t retirement from baseball at all. The next rich chapter in Yogi’s baseball career was just beginning. He was quickly hired as manager of the Yankees for a season before going across town to the Mets to work as part of Casey Stengel’s coaching staff.

Why is adriana lima retiring from vs?

Even though she is no longer with Victoria’s Secret, Adriana Lima plans to model for as long as she can. Leaving the brand gives her more time to focus on other modeling jobs, which might be one of the reasons that she quit. In 2019, she received the Daily Front Row’s Fashion Icon of the Year Award.

Is new mexico a bad place to retire?

New Mexico is a beguiling land of wonder that has rightfully earned its reputation as the land of enchantment. … Some potential pitfalls of retiring in New Mexico include a relatively high crime rate, poor infrastructure, roads, and long traffic jams.

Why did a rod retire?

Rodriguez still hit for power, but he struggled under the pressure of playing in New York. … This time, he signed a $275 million deal that would conceivably allow him to retire with the Yankees. Of course, his steroid-related issues came to light and overshadowed the end of his stellar playing career.

How old was jay feely when he retired?

Feely, 41, played for the Falcons, Giants, Dolphins, Chiefs, Jets, Cardinals and Bears over 14 NFL seasons. Upon his retirement in 2014, he joined CBS.

How does 403b retirement work?

Traditional 403(b): These retirement plans are funded with pre-tax dollars and the money inside grows on a tax-deferred basis. That just means you won’t pay taxes on the money now, but you’ll be taxed on the withdrawals you take out in retirement.

Can i take my retirement benefits overseas?

If you are a U.S. citizen who qualifies for retirement, disability, or survivors benefits, you can generally collect them while living outside the U.S. However, benefit payments cannot be made to recipients living in certain countries, such as Cuba and North Korea.

What is considered an employee retirement system of texas?

The State of Texas retirement plan is mandatory for most state agency employees and provides a lifetime annuity when they retire. … To help them with that, ERS offers the Texa$aver℠ 401(k) / 457 Program, with low-cost traditional and Roth options.

Is my postal fers retirement taxed?

Federal employees sometimes forget that their federal retirement pension *is* taxable. Your CSRS or FERS Pension will be taxed at ordinary income tax rates. Now – you will get your contributions back tax-free (since you already paid taxes on the money when it was taken out of your pay check).

How much average american retirement?

According to this survey by the Transamerica Center for Retirement Studies, the median retirement savings by age in the U.S. is: Americans in their 20s: $16,000. Americans in their 30s: $45,000. Americans in their 40s: $63,000.

Do retirees have to file taxes?

Retirees whose only source of income is Social Security generally will not owe any federal taxes and therefore don’t need to file a return with the IRS.

What do i get when i retire from the army?

Defined Benefit: Monthly retired pay for life after at least 20 years of service (so if you retire at 20 years of service, you will get 40% of your highest 36 months of base pay). Retired pay will be calculated as follows: (Years of creditable service x 2.0%) x average of highest 36 months basic pay.

Is a retirement rollover the same as a conversion?

A Roth IRA rollover (or conversion) shifts money from a traditional IRA or 401(k) into a Roth IRA. As a high-earner, you can get around Roth IRA income limits by doing a rollover, a process commonly referred to as a “backdoor Roth IRA.” You’ll owe tax on any amount you convert, and it could be substantial.