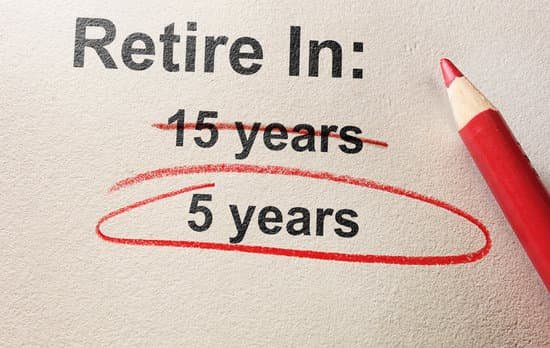

Why do people retire early? Many Americans plan to retire early, before the proverbial age of 65. Pros of retiring early include health benefits, opportunities to travel, or starting a new career or business venture. … There may be ways to chart a middle course—cutting back on work without fully retiring.

What does it mean to retire early? The common definition of early retirement is any age before 65—that’s when you qualify for Medicare benefits. Currently, men retire at an average age of 64, while for women the average retirement age is 62. Retiring before the traditional age of 65 can feel exciting and give you something to look forward to.

Why do some people retire early younger than 60? The two primary reasons some people retire before age 60. Adequate income and poor health. Family concerns are also influential. bridge jobs (between full employment and retirement), enabling older workers to work part-time.

What is a good age to retire? Age 65 has long been considered a typical retirement age, in part because of rules around Social Security benefits. In 1940, when the Social Security program began, workers could receive unreduced retirement benefits beginning at age 65.

Why do people retire early? – Related Questions

When retirement is a constructive discharge california?

Constructive discharge occurs when an employer engages in conduct that effectively forces the employee to resign or retire. Although the employee may say “I quit,” the employer relationship is actually terminated by the employer’s acts against the employee’s will.

What do most get for social security when i retire?

The maximum benefit — the most an individual retiree can get — is $3,345 a month for someone who files for Social Security in 2022 at full retirement age (FRA), the age at which you qualify for 100 percent of the benefit calculated from your earnings history.

What is the service corps of retired executives?

The Service Corps of Retired Executives (SCORE) is a national non-profit organization with members who provide free consultation services and advice to business owners and aspiring entrepreneurs.

Are millennials ready for retirement?

Older millennials currently have a median retirement savings rate of 13% of their income, according to the survey from CNBC Make It and Harris Poll. And millennials may be more focused on retirement than previous generations.

Is tuition tax exempt when taken out of retirement?

Distributions are tax-free as long as they are used for qualified education expenses, such as tuition and fees, required books, supplies and equipment and qualified expenses for room and board.

Where to retire in spain by the beach?

Alicante. This is the best place to retire in Spain. Due to its coast line which offers that much relaxing beach lifestyle which comes with almost an year amount of sunshine.

Can you retire at 65 with 500000?

“If you invest at an average return of 7% per year (not too big an “if”), your money will double every ten years. Therefore, if you have $500,000 at age 45, you can have $2 million at age 65 if you leave it alone.

How much can you earn when you retire at 62?

If you will reach full retirement age in 2021, you can earn up to $4,210 per month without losing any of your benefits, up until the month you turn 66. But for every $3 you earn over that amount in any month, you will lose $1 in Social Security benefits.

Can i retire at 55 and still work uk?

In the UK there are currently no age restrictions on retirement and generally, you can access your pension pot from as early as 55. … Working alongside a financial planner will help you work out if retiring at 55 is a possibility for you.

How much should i have in my retirement savings accounts?

Most financial experts end up suggesting you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000. Personal finance guru Suze Orman advises an eight-month emergency fund because that’s about how long it takes the average person to find a job.

Can i be medically retired?

Those with less than 20 years of active service and who have been awarded a disability rating of 30 percent (or higher) technically qualify for medical retirement. Those with a disability rating below 30 percent may experience medical separation instead of retirement.

How old can i be before i retire?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

What pension will i get when i retire in canada?

For 2019, the maximum monthly amount you could receive as a new recipient starting the pension at age 65 is $1,154.58. The average monthly amount is $679.16. Your situation will determine how much you’ll receive up to the maximum.

Do you give gifts for retirement party?

It’s generally expected that you’ll bring a gift or at least a card to a retirement party.

Why did bosch retire?

Bosch is suspended by their unit’s commander for a minor violation of departmental procedure after Soto and he cleared a tough homicide case. Bosch is forced to take retirement even though the disciplinary case against him is eventually dropped.

How arizona taxes retirees?

Arizona is moderately tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

How much money is needed per month in retirement?

How much will you need to retire at 67? Based on your projected savings and target age, you might have about $1,300 per month of income in retirement. If you save this amount by age 67, you will be able to spend $2,550 per month to support your living expenses in retirement.

How much superannuation do you need to retire in australia?

According to the Association of Superannuation Funds of Australia’s Retirement Standard, to have a ‘comfortable’ retirement, single people will need $545,000 in retirement savings, and couples will need $640,000.

Can a retired american live in germany?

As an American, you can stay in Germany for up to 90 days without a visa. … If you prefer, you can also apply for your temporary residence permit through the German consulate while you’re still in the U.S. This may be the safer plan; while plenty of Americans obtain permits for retirement, receiving one isn’t guaranteed.

Who gets retirement money in divorce?

If you are going through a divorce or legal separation, you will most likely be required to divide the assets you have in your retirement plans. In some cases, the assets may be awarded to one party.

What is considered good retirement income?

The U.S. Census Bureau reports the average retirement income for Americans over 65 years of age as both a median and a mean. In the most recent data from 2019, the figures were as follows: Median retirement income: $47,357. Mean retirement income: $73,288.